1. Overview

As an embark on renewable energy project in Vietnam, it isimportant to note that renewable energy has become a crucial solution toaddress environmental concerns, such as land pollution, water pollution, andglobal warming, and to promote sustainable living standards promoting a greeneconomy. Therefore, Vietnamese government has first demonstrated its commitmentto national energy security and sustainable development through its strategicorientation for sustainable energy development through 2030 and vision to 2045,as outlined in Decision No. 2068/QD-TTg dated November 25, 2015 (“Decision 2068”). Recently, the Central Committee promulgated Politburo’s ResolutionNo. 55-NQ/TW on orientations of strategy for national energy development by2030 with a vision towards 2045 onFebruary 11, 2020 (“Resolution55”).

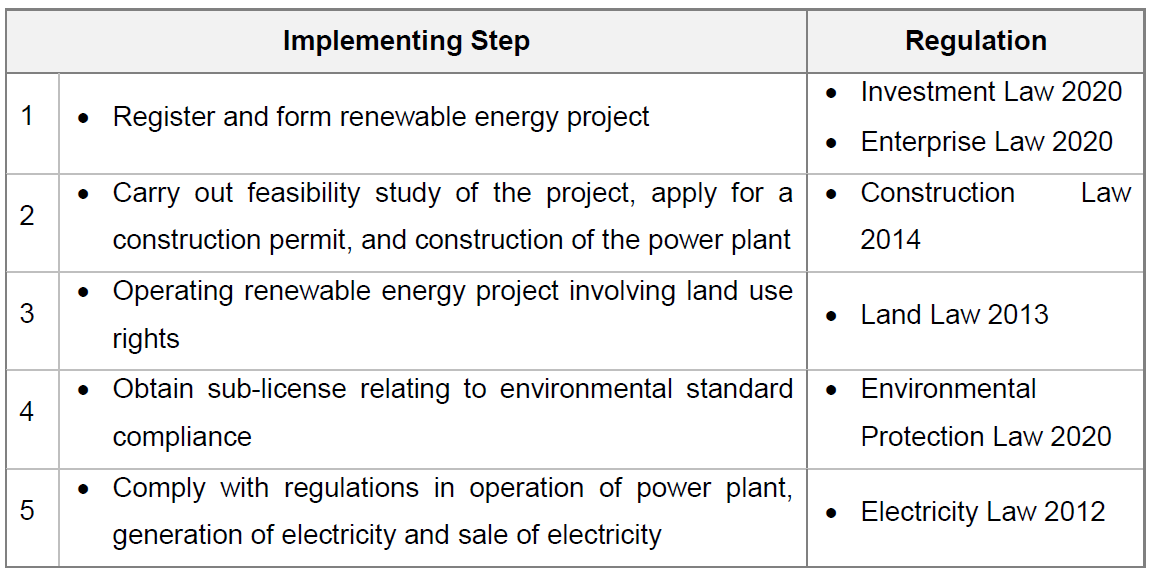

Throughthese general strategies, the Government stated the mission to devisebreakthrough policies and mechanisms to encourage robust development ofrenewable energy sources. Regulations governing the process for development ofa renewable power project is not included in in one specific law but arescattered in different legal documents, including:

2. Promotion measures in renewable energy for foreigninvestors

Vietnam'sunique geographical location with abundant resources makes it an excellentplace to invest in renewable energy, such as solar and wind power projects. Byinvesting in renewable energy projects in Vietnam is being considered tocontribute to the “green energy” development goals, so that can be benefit fromthe government's supportive policies and favorable conditions. It is worth noting that to date, all investmentprojects in renewable energy have been licensed under various law regime sincelong time ago, which is entitled to various incentives from the government,mainly categorized as: (i) feed-in-tariffs/tax, (ii) investment credit, (iii) land, and (iv) incentives for research and development in thehigh-technology sector, recently being updated asfollows:

2.1. Feed-in-Tariff/Tax incentives

On January 07, 2023, the Ministry of Industry and Trade (“MOIT”) promulgates new ceiling prices annuallyfor solar and wind energy in Vietnam, which is the basis for VietnamElectricity (EVN) to enter into tariff negotiations with developers oftransitional solar and wind energy. Maximum electricity prices (exclusive ofVAT) applied to transitional solar power plants and wind power plants in 2023are specified below[1]:

Regardingimport tax incentives: the development projectsproducing renewableenergy shall be entitled to import duty for such imported goods as raw materials, supplies andcomponents that cannot be domestically manufactured and are imported formanufacture of the projects in accordance with current regulations of law onimport and export tax. Projects willalso be exempt from import tax for imported goods within 05 years from the manufacture commencement date,provided that the imported goods fall within the specified products as above[2].

Regarding corporate income tax (“CIT”):an exemption and reduction of CIT for the development projects using renewableenergy shall be done the same as the projects in the field of investmentincentives in accordance with current regulations of law on tax. In particular,Article 15 Decree 218/2013/ND-CP dated December 26, 2013 (“Decree 218”) and Decree 12/2015/ND-CPdated February 12, 2015 (“Decree 12”)stipulates that:

(i) Projects producing renewableenergy shall be entitled to receive an incentive tax rate of 10% within 15years. This sector may also receive tax exemption and reduction, including 04year of tax exemption and 50% of tax reduction for the following 09 years[3].Hence, the projects will be CIT exempted from the first 04 years of revenuegeneration, followed by 09 years of 50% tax and 02 years of 10% tax beforebeing subject to the standard CIT rate of 20%.

(ii) Manufacturing projects of newenergies, clean energies, energy-saving technology registering capital in whichis disbursed within 05 years from the day on which the investment is licensed,may apply for the extended duration of application of concessional tax up to 15years.

(iii) Projectsthat are large-scale and require special investment attraction due to high ornew technology, the duration for the incentive tax rate may be extended beyond15 years, but the total period of the reduced tax rate of 10% shall not exceed30 years.

2.2. Investment credit incentives

Investment projects on building power plants using wind orsolar power, geothermic, biological or biomass energy and other renewableenergy resources are eligible for state investment loans from the VietnamDevelopment Bank to conduct production and business activities. Accordingly,the investor may borrow up to 70% of the total investment capital for suchprojects, with a maximum loan term of 15 years.

Moreover, the State Bank’s Governor issued promulgating thestrategy for developing Vietnam’s banking industry by 2025 with a visiontowards 2030 as the basis for Decree No. 08/2022/ND-CP dated January 7, 2019for the investment projects offering environmental benefit are entitled to begranted green credit and issue green bonds. With aforementioned incentives, aseries of banks have been implementing lending programs for renewable energyprojects with very large lending rates. The loan ratio of the projectinvestment capital requirement in VPBank, VietCapital Bank are up to 80%, 85%respectively.

2.3. Land incentives

The investor with renewable energy projects in Vietnamshall receive the exemption or reduction of land use fees or land leasing feesin accordance with current regulations. In general, the projects are entitledto exemption of land rental for up to 03 years for fundamental constructioncommencing on the date of the land lease decision. Other than that, pursuant toDecree 46/2014/ND-CP dated May 15, 2014 (“Decree46”) and Decree 135/2016/ND-CP dated September 9, 2016 (“Decree 135”), the projects may applyfor extension of exemption which depends on the project’s location as follows:

(i) For projects locating inareas outside the list of administrative divisions of investment incentives: 11years after the period of fundamental construction.

(ii) For projects locating in areas under thelist of administrative divisions facing difficult socio-economic conditions: 15years after the period of fundamental construction.

(iii) Forprojects in administrative divisions of rural districts belonging to the listof administrative divisions facing extremely difficult socio-economicconditions: entire lease termunder the land lease decision.

2.4. Incentives for research relating to development andusage of renewable energy in high-technology sector

Priority is given to the research related to thedevelopment and use of natural resources of renewable energy in the field ofscientific and technological development and high-tech industrial development. TheVietnamese government has prioritized the development of renewable energy andhigh-tech industries. The Ministry of Science and Technology has issuedDecision No. 38/2020/QD-TTG dated December 30, 2020, which lists hightechnologies that are prioritized for development investment[4],and encouraged for development[5],including but not limited as follows:

(i) Hydrogen energy;

(ii) Power generation technologies using largecapacity renewable energy storage;

(iii) Technologyfor designing and manufacturing control devices and power electronicsconverters for renewable energy generating stations;

(iv) High capacity,large capacity renewable energy storage systems and equipment;

(v) Control equipment, high-performanceelectronic conversion equipment for renewable energygenerating stations.

Furthermore, the renewable companies who are eligible forthe high technologies given priority according to the Decision 38 above will beapplied with an incentive tax of 10% rate for 15 years[6].These initiatives could have significant implications for the country'srenewable energy landscape and economic development in Vietnam.

3. Conclusion

In conclusion, investing in renewable energy projects inVietnam can be a viable option for investors looking to diversify theirportfolios and contribute to sustainable development. However, investors shouldbe aware of the legal issues and regulatory challenges that they may faceduring the project development and operation phases. The scattered regulationsrelated to renewable energy projects in Vietnam can make compliance a complextask, especially for foreign investors. Additionally, conducting a thorough duediligence investigation of the project and the company proposing the projectcan help identify potential legal or regulatory issues and minimize risks. Ultimately, compliance with all applicable laws and regulations is crucial to thelong-term success of the renewable energy project in Vietnam.

[1] Decision No. 21/QĐ-BCT dated January 07,2023 on promulgation of the transitional framework for electricity prices ofsolar power plants wind power plants.

[2] Article 12.19 The Law on export and importduties 2016, Article 1.8 Decree No. 18/2021/ND-CP dated March 11, 2021.

[3] Article 3 Circular 212/2015/TT-BTC datedDecember 31, 2015 (“Circular 212”), Article 12 Circular 96/2015/TT-BTC datedJune 22, 2015 (“Circular 96”)

[4] Appendix I Decision No. 38/2020/QD-TTGdated December 30, 2020

[5] Appendix II Decision No. 38/2020/QD-TTGdated December 30, 2020

[6] Article 11 (b) Circular 96/2015/TT-BTCdated June 22, 2015

Disclaimer: ThisBriefing is for information purposes only. Its contents do not constitute legaladvice and should not be regarded as detailed advice in individual cases. Forlegal advice, please contact our Partners